By Keith Lawrence Miller, M.A., Founder – Ivy League Résumés

Private equity is one of the most competitive, coveted, and highly selective career paths in the world. Whether you’re entering PE from investment banking, seeking a role with a middle-market fund, joining a mega-fund, or transitioning into a portfolio operations role, your résumé must demonstrate:

-

Investment judgment

-

Commercial intelligence

-

Value creation expertise

-

Financial modeling and deal execution skills

-

Operational and strategic maturity

-

Transformation capability within portfolio companies

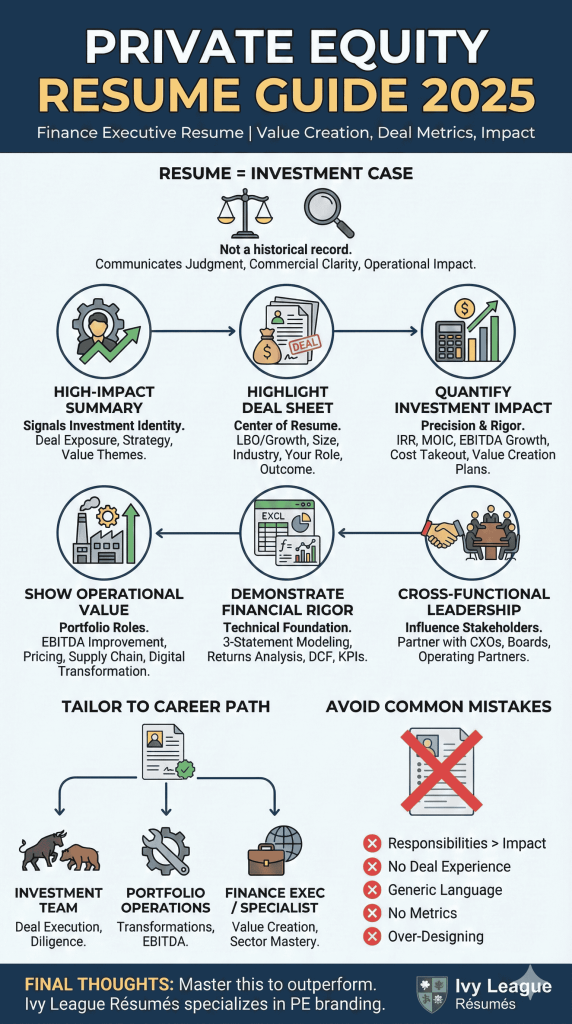

A private equity résumé is not a traditional finance résumé. It must communicate impact, judgment, and value creation within seconds.

This guide breaks down exactly how to write a PE résumé that resonates with fund partners, hiring managers, and portfolio operators.

Why Private Equity Résumés Are Different

Private equity firms look for a very specific kind of professional — someone who can:

-

Evaluate businesses with precision

-

Model financial outcomes

-

Build investment theses

-

Execute transactions

-

Drive value creation

-

Improve operations

-

Work with management teams

-

Deliver measurable returns

Your résumé must speak the language of returns, growth, and operational transformation — not just tasks or responsibilities.

PE is not banking. PE is not consulting. PE is not corporate finance. It’s a synthesis of all three — with a focus on ownership and value creation.

The 2025 Private Equity Resume Framework

Below is the exact structure used for finance executives, PE associates, VPs, operating partners, CFOs, and portfolio operators across mid-market and mega-fund environments.

1. Start With a High-Impact Summary That Signals Your Investment Identity

Your opening must answer:

“What type of investor or operator are you?”

The summary should include:

-

Deal exposure

-

Investment strategy (LMM, MM, UMM, mega-fund)

-

Industry focus (if applicable)

-

Value creation themes

-

Financial competencies

-

Operating experience (if relevant)

Example: Private equity investment professional with experience across leveraged buyouts, growth equity, and operational value creation initiatives. Skilled in financial modeling, commercial diligence, and supporting management teams through strategic, operational, and financial transformations.

This immediately communicates your investment maturity.

2. Highlight Deal Sheet / Transaction Experience (Non-Negotiable)

The deal sheet is the center of a private equity résumé.

Strong PE résumés highlight:

-

Type of deal (LBO, growth equity, add-on, carve-out, recapitalization)

-

Deal size ($X million or $X billion EV)

-

Industry

-

Your contribution (analysis, diligence, modeling, operating plan)

-

Outcome (closed, in diligence, exited, ROI if public)

Example format:

SELECT TRANSACTION EXPERIENCE

-

$450M LBO – Industrial Services: Led financial modeling, developed operating cases, supported commercial diligence, evaluated synergies, and contributed to value creation planning.

-

$120M Growth Equity – SaaS: Oversaw ARR cohort analysis, churn modeling, market sizing, and competitive benchmarking.

-

$900M Add-On Acquisition – Healthcare Services: Assessed integration risks, cost synergy opportunities, and management team capability.

PE résumés without deal details are ignored.

3. Quantify Investment Impact Wherever Possible

PE hiring managers look for:

-

Precision

-

Analytical rigor

-

Commercial logic

Examples of high-value bullet points:

-

Modeled $1.2B LBO, analyzing cash flows, capital structure, and credit sensitivity.

-

Performed commercial diligence across 10+ deals, evaluating market structure, competitive dynamics, and customer concentration risk.

-

Built investment committee materials used for go/no-go decisions.

-

Partnered with management teams to develop 100-day value creation plans.

-

Identified $15M+ in operational improvement opportunities across portfolio.

Impact is the currency of PE.

4. Show Operational Value Creation (Especially for Portfolio Roles)

Funds are increasingly prioritizing operators — not just modelers.

Operating partner résumés should highlight:

-

EBITDA improvement

-

Pricing strategy

-

Sales acceleration

-

Supply chain optimization

-

Cost takeout

-

FP&A enhancement

-

Digital transformation

-

SG&A restructuring

Example bullets:

-

Improved EBITDA by 18% by redesigning pricing structure across key product lines.

-

Reduced SG&A by $6.4M through zero-based budgeting and org restructuring.

-

Implemented KPI dashboards improving decision-making and forecasting accuracy.

This is what separates PE operators from corporate executives.

5. Demonstrate Financial Rigor (Modeling, IC Materials, Diligence)

Private equity résumés must demonstrate:

-

3-statement modeling

-

Returns analysis (IRR, MOIC)

-

Debt structuring

-

Sensitivity analysis

-

Comps, precedents, DCF

-

Cohort analysis

-

Churn modeling

-

LTV/CAC analysis (for growth equity)

-

Operational KPIs

This proves your technical foundation.

6. Emphasize Cross-Functional Leadership and Management Interaction

PE professionals must influence:

-

CEOs

-

CFOs

-

COOs

-

Founders

-

Boards

-

Operating partners

-

Consultants

-

Bankers

Strong résumé language includes:

-

“Partnered with management…”

-

“Supported CEO and CFO…”

-

“Worked directly with board members…”

-

“Collaborated with consultants to execute market studies…”

PE is relationship-driven. Your résumé must show you can operate in high-stakes environments.

7. Include Relevant Tools, Certifications & Technical Skills

Finance resumes should include:

-

Excel (advanced modeling)

-

PowerPoint (IC materials, presentations)

-

Capital IQ

-

PitchBook

-

FactSet

-

Python/R (if relevant)

-

ESG frameworks (if relevant)

Executive-level:

-

CPA, CFA, MBA (top-tier programs)

8. Tailor Your Resume to Your PE Career Path

There are different types of PE career tracks:

Investment Team (Associate → VP → Principal → Partner)

Focus on:

-

Financial rigor

-

Deal execution

-

Diligence

-

Thesis creation

Portfolio Operations (Ops, COO, CFO, CRO, Transformation Lead)

Focus on:

-

EBITDA impact

-

Transformations

-

Operational improvements

Industry Specialists (Healthcare, Tech, Industrial, Consumer)

Focus on:

-

Sector mastery

-

Market knowledge

-

Strategic insights

Finance Executives Transitioning Into PE

Focus on:

-

Value creation

-

Financial performance

-

Executive decision-making

Each requires a unique narrative and résumé structure.

9. For Senior Leaders: Build a PE-Ready Leadership Story

Finance executives moving into PE (especially portfolio roles) need a narrative that shows:

-

Strategic clarity

-

Cross-functional expertise

-

Transformation leadership

-

Measureable business impact

-

Investor-minded thinking

Examples:

-

“Drives enterprise value through disciplined financial leadership and operational excellence.”

-

“Combines investment acumen with operational execution to deliver measurable EBITDA outcomes.”

This positions you for both operating partner and C-suite roles.

10. Avoid the Most Common PE Resume Mistakes

Executives and associates frequently fail by:

❌ Listing responsibilities instead of impact ❌ Omitting deal experience ❌ Using generic finance language ❌ Over-explaining and losing clarity ❌ Excluding metrics ❌ Over-designing the résumé ❌ Not tailoring for investment vs. operations ❌ Including irrelevant internships

PE hiring managers want precision, not volume.

Private Equity Resume Template — Short Example Structure

Name Contact | LinkedIn | Location

SUMMARY 2–4 lines summarizing investment identity, sector focus, value creation strengths.

SELECT TRANSACTION EXPERIENCE 3–5 core deals with specifics.

EXPERIENCE Company | Title | Dates

-

Quantified impact

-

Modeling, diligence, IC prep

-

Partnership with management

-

Value creation insights

EDUCATION MBA, CFA, CPA (if applicable)

SKILLS Financial modeling, LBO, DCF, diligence, operational KPIs, etc.

Final Thoughts: A Private Equity Resume Is a Value Creation Document

A PE résumé is not a historical record — it is an investment case. It must communicate:

-

Judgment

-

Capability

-

Strategic thinking

-

Commercial clarity

-

Technical mastery

-

Operational impact

-

Partnership ability

-

Value creation mindset

Executives and investment professionals who master this résumé style outperform others in interviews, fund placement, and compensation negotiations.

If you want a PE résumé that matches the sophistication of the industry — Ivy League Résumés specializes in private equity, finance executive, and portfolio operator branding.

If you’re ready to build a private equity résumé that speaks the language of value creation and investment judgment, Ivy League Résumés can build it with you.